Accounting 101 For Small Business Owners: What You Need To Know

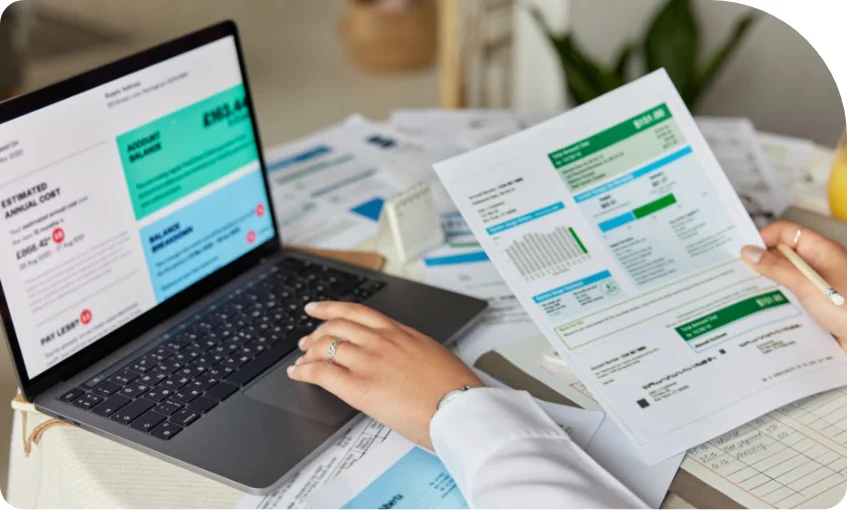

Starting a small business is exciting! You’ve turned your passion into a venture, but now comes the part that makes many entrepreneurs nervous: managing the

Reduce your tax liability strategically. Our tax planners use their broad understanding to find legal benefits and create customized strategies that lower your tax burden. We handle the complexities, ensuring compliance while maximizing your after-tax income and financial goals.

Many small business owners wonder when to start tax planning. The answer is right now. Effective tax planning must be proactive so whether your small business is new or established, when we become your CPA firm, we’ll begin planning for tax time immediately. We’ll work throughout the year to help you get all of the tax breaks available to your business so you save the most money possible. We look at everything from last year’s tax return to your business entity to identify how to reduce tax liabilities and increase profits. Our tax planning strategies are reliable, ethical, and effective for all types of small businesses. For individuals, we also recommend a variety of techniques to maximize after-tax income and put more cash in your wallet.

Tax laws are constantly changing and being revised. This can provide opportunities to take advantage of different deductions and save you more money. Using the latest tax legislation, our tax preparation and planning services identify the best ways to legally lighten your tax burden, keep you in compliance, and avoid trouble with the IRS.

Find out how our tax planning services can minimize tax exposure for you and your business. Call (346) 463-7770 or request a consultation to get started.

We look at your finances to find tax-saving opportunities and create a personalized plan to reduce your tax obligation.

Our tax specialists stay updated on the latest tax laws so you claim all possible deductions and credits.

If you are audited by the IRS, we can help you and protect your interests while reducing any possible fines.

Many big life events, such as marriage, retirement, or establishing a company, have tax implications, and we’re here to help you sort them out.

Take Advantage of Our Tax Planning Services to Increase Your Wealth

We assist with minimizing tax liability, claiming deductions and credits, providing audit defense, and evaluating the tax implications of significant life events.

Evaluate current and potential tax liabilities based on income, investments, and assets.

Develop personalized strategies to legally minimize taxes through deductions, credits, and exemptions.

File tax returns accurately and on time to meet regulatory requirements.

Analyze the tax implications of investment decisions to optimize after-tax returns.

Structure retirement accounts and withdrawals to minimize taxes during retirement years.

Develop strategies to minimize estate and inheritance taxes and facilitate smooth wealth transfer to heirs.

We begin by understanding your financial situation, goals, and potential tax exposures.

We create tax plans that meet your demands and maximize tax efficiency.

We apply the designed tax strategy and handle all paperwork, filings, and revisions to optimize savings and compliance.

You can rest knowing that your finances are in good order.

Simplify your taxes. Our cloud-based platform looks at your funds to find hidden charges. Cut down on taxes, save as much as possible, and stay compliant.

Tax strategies should be customized to your financial situation, objectives, and risk tolerance for the best savings and compliance.

You can relax knowing your taxes are in excellent hands since we stay current to optimize and comply with your plan.

We offer full tax services to protect your financial future, from reducing your income taxes to planning your assets.

Our simplified methods and user-friendly technologies make tax preparation easy and convenient.

We develop lasting partnerships and improve your tax methods to adapt to your changing financial condition and legislative changes, not only save you money.

We’re based out of Richmond, Tx.

Our office hours are 8:30am-5pm, Monday to Friday. You can speak to one of our small business accountants during office hours on (346) 463-7770 or find out more about our services by visiting our Facebook page or LinkedIn page.

Tax planning can benefit everyone. It’s especially helpful if you have a complex financial situation, are self-employed, or are expecting major life changes.

Tax planning should be reviewed regularly, especially when significant life events occur, tax laws change, or financial goals evolve.

No, tax planning services are beneficial for individuals at all income levels.

It’s best to start tax planning as early as possible, ideally at the beginning of the fiscal year, to maximize savings and ensure proper implementation of strategies.

Savings vary based on your situation, but proper planning can significantly reduce your tax liability.

Starting a small business is exciting! You’ve turned your passion into a venture, but now comes the part that makes many entrepreneurs nervous: managing the

Running a small business means wearing multiple hats. You’re the CEO, marketing director, and often the accountant too. But here’s the reality: poor accounting practices

Small business owners across Texas and beyond are increasingly turning to outsourced accounting services to alleviate these financial burdens. The trend isn’t just about saving

Contact us before this offer ends to lock in discounted year-end rates!